Views

Water companies deliver record levels of investment, with even more needed in the coming decades

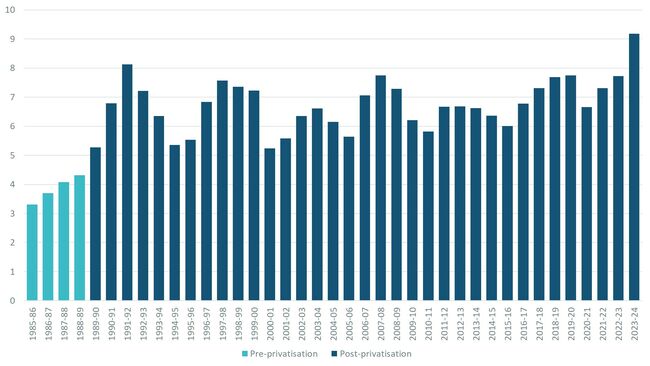

Last year, the water sector in England and Wales delivered the most capital investment ever in a single year.

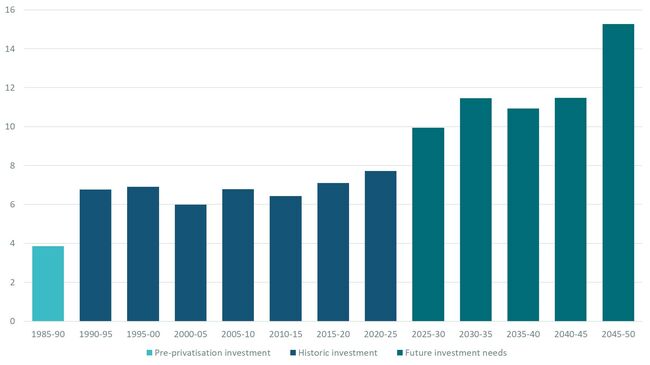

Based on new figures from the economic regulator Ofwat, water companies in England and Wales delivered £9.2bn of capital investment in 2023-24. This is up nearly a fifth (18.8%) on the previous year, and more than double the annual levels in the years immediately before the sector was privatised in 1989.

Figure 1 – Annual capital investment by water companies in England and Wales from 1985-86 to 2023-24 (£bn, 2023-24 prices)

Why does it matter?

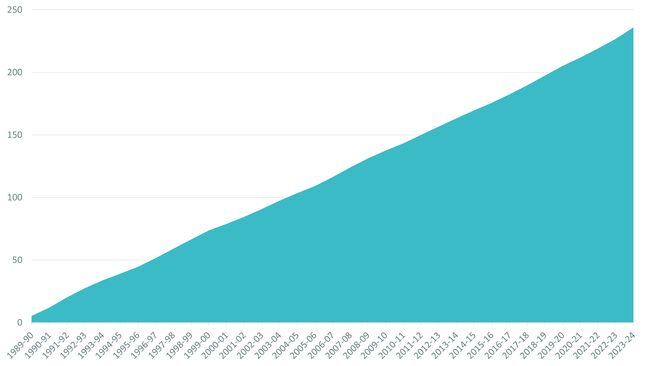

Water companies have now invested more than £236bn of capital investment in the water and sewage system in England and Wales over 1989-90 to 2023-24. This is equivalent to nearly £10,000 for every household.

Figure 2 – Cumulative capital investment by water companies in England and Wales since privatisation (£bn, 2023-24 prices)

These levels of investment have been made possible by the funding model that we have in the water sector in England and Wales, which avoids customers having to either wait for, or not receive, these levels of investment. This is because the water sector in England and Wales has a model that can best be described as ‘build now, pay later’. This means that once they get approval from regulators, water companies can get on and invest in building and upgrading infrastructure, like our sewers and pipes, and installing new cutting-edge technology that will help to deliver environmental improvements.

Customers experience these improvements as soon as they are built, without needing to pay for them immediately through their bills. Instead, investors provide the money for this capital investment upfront, and are paid back over time through customer bills. Until they are paid back, investors receive a small financial return, which is set by Ofwat.

While customers generally do not pay for capital investment upfront in their bills, they do pay for the day-to-day operating costs such as energy and wages. Last year operating expenditure was £6.1bn, less than capital investment in the same year.

Is this enough for the future?

While the water sector has delivered substantial levels of private investment since 1989, even more is needed to meet the challenges and pressures created by climate change, population growth and environmental standards demanded by customers.

Companies have accelerated some investment in the last year, supported by the government and regulators, but more will be required.

We can expect to see annual investment levels reach even higher levels over the coming years. Before privatisation, annual investment levels were around £3.8bn. Companies are proposing to invest nearly £10bn a year over the next five years, rising to £11.5bn a year over 2030 to 2035, and to more than £15bn a year by 2050.

Figure 3 – Annual average capital investment by water companies in England and Wales, grouped by five-year investment periods (£bn, 2023-24 prices)

Given the investment needs of the water sector to meet the challenges that we face, we can expect to see even more records broken over the coming decades.